In this article you will find:

Porter's Five Forces Model

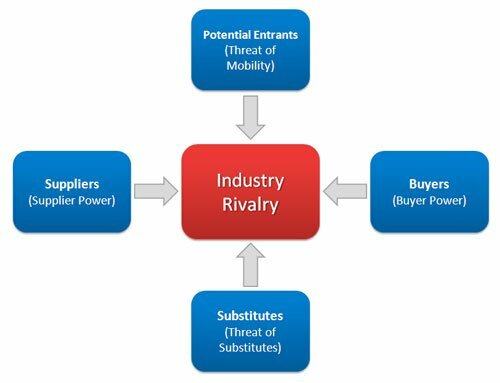

Rivalry in markets is good for consumers. It forces companies to provide superior service or they will simply face financial ruin. Michael Porter's Five Forces Theory it's a model for business management and for economic management that focuses on rivalry between companies in a specific market. Like the analysis of the value chain and the SWOT analysis, this model is useful for the strategic planning of the company.

Advertisements

General Considerations of Porter's Five Forces Theory

Porter's Five Forces Theory It is a complex analysis model of business competition in a market. The dependent variable, that is, the variable that will be explained, is the intensity of the rivalry between the companies. The independent variables, that is, the forces that explain the rivalry, are reduced to four:

- Bargaining power of suppliers

- Bargaining power of customers

- Threat of new competitors

- Substitute product threat

All these variables will finally be integrated to explain and understand the intensity (or lack of it) of competition and business rivalry in a given market.

Advertisements

Porter's Five Forces Model Features

For example, if consumers can easily substitute one type of product for another (alcohol instead antidepressants, for example), companies will compete more intensely to keep customers. If buyers have great bargaining power (that is, if they are well organized), then they may be able to establish the terms of the transactions. Another good example is the multinational company Walmart. Walmart could set the conditions for the production of basic inputs because buy in large volume and guarantee a large market for all suppliers that meet their rules. Therefore the rivalry between Walmart's suppliers would become intense. If not, if producers have the power, they can easily raise prices. For example, if the raw materials are in the hands of a few suppliers (say wheat), the suppliers could force those who need the product into intense rivalry for a good deal. Finally, if there are high barriers to entry into a market specific, then the rivalry is reduced, as new competitors will have great difficulty entering. When profits go up, more competitors enter the market. When profits go down, the opposite happens. This is the basic dynamic in which all of these forces work together to determine the nature of competition.

Role of Porter's Five Forces Theory within a Firm

This approach exposes the main variables that determine the levels of competition between companies. An administrator can then schematically establish these variables in order to arrive at a rational decision on cost reduction or the commercialization of new products. It is a very rational way for managers to make decisions, and different types of companies will then have different marketing approaches for certain markets.

Advertisements

Interpretation of Porter's Five Forces Model

On Porter's Five Forces Theory the real concept is that companies are not equal within a market. Many times these forces differ from reality and have a much more complex interpretation. If an industry is protected by a patent, for example, then rivalry is reduced and profits (and control of the market) rise. If, for example, pharmaceutical company patents for a new treatment for depression, then managers will move quickly to take as much of the market as may be possible. Once the patent expires, the strategy becomes very different.

Therefore the competitive analysis of a company must be much broader.

Advertisements

Profits

The benefits of Porter's five forces model is that it tries to understand the market as a complex mixture of real and tangible factors, and not as a set of mathematical forces so dear to professional economists and economists. statesmen. Porter's approach to competition and rivalry between companies goes through qualitative analysis, which is very important when making decisions.

How to Apply Porter's Five Forces Model in a Business

The five forces model It was developed in 1979 by Michael Porter, a highly acclaimed strategist and professor at Harvard Business School. The model is used to identify and analyze the forces affecting an industry. According to the model, companies must assess the opportunities and threats posed by current competitors, potential competitors competitors, the availability of substitute products in the market, and the bargaining power of its customers and suppliers.

Advertisements

If you need to know more about the Porter's theory, you can visit this link.

Rivalry

The first thing we have to do to analyze the rivalry of the market is to determine the position of the company compared to its competitors. To do this, we must measure competitiveness through market share covered and market penetration.

Second, we must compare the prices of the products, the technology, the innovations and the quality of the products of your competitors. This will give an idea of whether the market has a low rivalry between the companies or a high rivalry.

It is also important to develop marketing and advertising strategies for your products. This will ensure that more people know about our products which can help us gain a competitive advantage.

Threat of new competitors

This point refers to barriers to entry. In Porter's five forces model, entry barriers have to do with the degree of difficulty with which a new company can enter the market. At this point it is important to review the government policies of a specific market. The government sometimes places restrictions on the entry of new players into the market by granting monopolies and acting as a regulator. It is also important to know about the patents and licenses required to enter a certain line of business. Understand the procedures in developing and acquiring them to determine the level of difficulty of entering the industry.

From the point of view of the new entrant we must calculate »the internal economies of scale. »This will help you determine the market share that you can expect as a new entrant. This will reveal whether it is profitable to enter that market.

The power of provider's negociation

At this point we have to analyze the existing relationships with our suppliers of raw materials and labor. Also, you must analyze what the scenario would be in case the prices of your goods increase or they refuse to supply us.

It is also ideal to do an analysis to determine the costs associated with making a supplier change. For this we must create a matrix that considers the additional costs - or savings - involved in making the change.

The bargaining power of buyers

It is very important to know our customers well and to know for example how they react to price changes, and to predict the potential effects of adjusting the price of your product.

The threat of substitutes

To be aware of substitute products it is very important to do a thorough study and assess your propensity to find substitutes for your main products. It would not hurt to evaluate the quality of the products that can be substituted for your product.

We can also create a compensation matrix to understand the advantages and disadvantages associated with staying with or finding a replacement for our product.