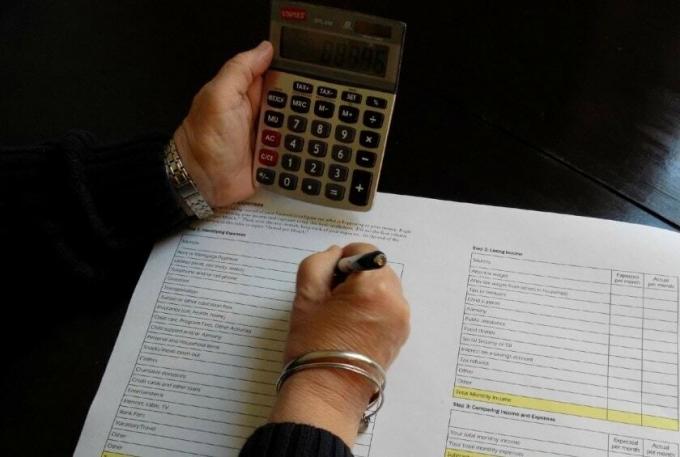

The financial study can be referred to as a process to understand the risk and profitability of a company by analyzing the reported financial information. Especially in the annual and quarterly reports. In other words, the financial study of a project is a study about the accounting relationships between various elements included in the balance sheet.

These ratios include asset utilization ratios, profitability ratios, leverage ratios, liquidity ratios, and valuation ratios. In addition, this is a quantification method to determine the past, current and future performance of a company.

Advertisements

It is considered one of the best ways to analyze the fundamentals of a business. It helps us understand the financial performance of the company derived from its financial statements. This is an important metric to analyze the operating profitability, liquidity, leverage, etc., of the company.

Advertisements

An example of a financial study is when analyzing the performance and trend of the company

Through this, we can evaluate the profitability and profit trend of the company and know if there are more ratios such as liquidity ratios, turnover ratios and solvency ratios.

Advertisements

In this article you will find:

Advantages of the financial study

The different advantages of financial study are listed below:

- The most important benefit is that provides investors with insight into the decision to invest their funds in a particular company.

- Another advantage of the financial study for a project is that the regulatory authorities can ensure that the company follows the required accounting standards.

- The financial study is useful for government agencies when analyzing the taxes owed to the business.

- Above all, the company can analyze its own performance over a specific period of time.

Limitations of the financial study

Although the financial study is a very useful tool, it also presents some limitations, including comparability of financial data and the need to look beyond the indices.

Advertisements

Although comparisons between two companies can provide valuable clues about a company's financial health, sadly, differences between companies' accounting methods make it difficult to compare data at times of both.

In addition, sufficient data is often available in the form of footnotes to the financial statements to restate the data in a comparable way. Or, the analyst must remember the lack of comparability of the data before reaching a clear conclusion.

Advertisements

However, even with this limitation, comparisons between two companies' key ratios along with industry averages often propose avenues for further investigation.

Types of financial analysis

There are countless techniques that can be used to analyze the performance of a business enterprise, but the most common methods use the following strategies:

- Horizontal analysis- This method uses past performance as a benchmark for business success. There are variations on this method that some years may use as the standard. For example, if the company has been around for some time, the previous two years can be used as a comparison. If the company is relatively new, it is common to use the starting year as a baseline and plot performance against it.

- Vertical analysis- Also known as component percentages, this type of analysis compares earnings to assets, liabilities, and stocks. This method is generally useful when comparing a large number of similar companies. The limitation of this method is that it often does not take into account factors that adequately affect future viability, such as long-term partnerships and one-time losses or investments.

- Relationship analysis: This method analyzes various aspects of the financial health of the company. For example, a current relationship is the comparison of assets with liabilities. This type of analysis is extremely popular due to the analyst's ability to choose two key characteristics of companies to analyze. Many analysts use this type of analysis to support their evaluations of organizations, even if conventional analytical methodologies may not be as positive. The weakness in this type of analysis is that if the two characteristics are chosen poorly, an unreliable estimate of financial viability can result.

- Stock price movement: This technique is based on analyzing the performance of the company's shares rather than its financial health. In essence, this method uses financial markets as an analytical tool. Several methods can be used to evaluate the performance of stocks, including widening or narrowing the evaluation window, comparing with similar companies, and analyzing trends.

Steps to carry out a financial study of a project

There are generally six steps to developing an effective financial study.

- Identify economic characteristics of the industry.

First, determine a value chain analysis for the industry

- Identify company strategies.

Next, the nature of the product / service offered by the company should be observed, including the product uniqueness, level of profit margins, building brand loyalty and controlling the costs.

- Evaluate the quality of financial statements of the company.

Reviews key financial statements within the context of relevant accounting standards. When examining the balance sheet accounts, issues such as recognition, valuation and classification are key to a proper evaluation.

- Analyze profitability and current risk.

This is the step where financial professionals can really add value in evaluating the company and its financial statements.

- Prepare financial studies planned.

Although often challenging, financial professionals should make reasonable assumptions about the future of the company. company (and its industry) and determine how these assumptions will affect both cash flows and financing.

- Value the company.

While there are many valuation approaches, the most common is a discounted cash flow type of methodology.