The CAUE and BAUE they are the equivalent annual Cost and the equivalent annual Profit respectively. These two indicators are used in the evaluation of investment projects and correspond to all income and disbursements converted into an equivalent uniform annual amount that is the same each period.

For example, if a homeowner had a three-year investment, the equivalent annual cost would be to calculate the investment costs per year based on what will be spent in the lump sum. This is useful when comparing the annual cost of investments that cover different time periods.

Advertisements

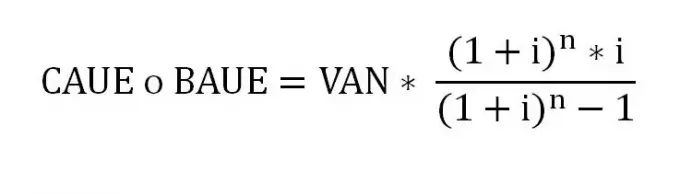

The formula for these indicators is the same. It all depends on what you want to measure. If you want to measure costs, you will use the CAUE (the lower it is, the better the option to choose). If you want to measure the benefits or gains, the greater BAUE.

This evaluation criterion is useful in those cases in which the IRR and the GO they are not entirely accurate.

Advertisements

Its formula is given by:

Advertisements

Where:

i: Corresponds to the interest rate

Advertisements

n: Corresponds to the number of periods to evaluate

Solved exercises of the CAUE

Advertisements