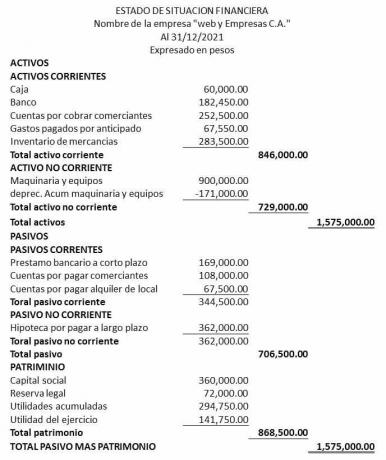

Every company must keep an accounting record of all its operations or transactions, according to their nature and behavior, they are classified into three main categories such as assets, Passives and capital.

The asset incorporates what the company owns or has that which at the end of the fiscal year represents its liquidity.

Advertisements

The liability incorporates all the debts or obligations of the company with its suppliers of services or goods, among others.

Capital incorporates those assets owned by the company, after determining the difference between assets and liabilities, during the period of the accounting year.

Advertisements

In this article you will find:

Asset classification

The asset is classified as current and fixed. The current assets is sub-classified into available and realizable assets, within this classification is the definition of current.

Advertisements

Based on the above, you can answer the question What is the current in accounting? Then we speak of current assets, which is assigned the qualification of "current" due to its characteristic mobilization.

Therefore, the current is used to incorporate transactions directly related to the cash accounts, banks, merchandise inventory, merchandise in transit, prepaid expenses and insurance, among others accounts.

Advertisements

It is also indicated as floating due to the fact that the transactions are recorded as operations. include accounts that are mobilized quite frequently and these in turn constitute the assets or rights of a business.

Definition of current in accounting

To explain it in a practical way, it can be said that the current represents accounts in constant movement, that is, they circulate or run assiduously. One of the best examples of this is the banking movements of a company, where the deposits in account for income are reflected in the company for the sale of goods and services and the issuance of checks and transfers for payments to suppliers and other expenses are also reflected.

Advertisements

Another important example is the inventory of merchandise, considered as "current" due to its entry and exit movements, since any company that carries stock control, sells goods and buys again, there is a constant turnover.

Other accounts considered within this category are accounts and receivables, because thanks to the behavior of customers, there is the movement or current of the accounts, while the client invoices, pays the debt acquired with the company and buys again goods.

Current characteristics

- they are immediately available, transformable and realizable accounts.

- They are accounts payable in the short and medium term.

Current rating

- Circulating immediately cash or cash equivalent, it is known as the available current, where they enter: cash, petty cash, banks, negotiable investments.

- Short-term accounts and notes receivable, generally includes credits allowable from 7 to 15 days.

- Provisions for uncollectible accounts, to offset the expenses for losses on uncollectible accounts.

- Rents receivable.

- Interest receivable, endorsed receivables.

- Some financial assets such as insurance requirements, accounts receivable from related companies, accounts receivable from shareholders, accounts receivable from partners, loans to employees and others.

- Taxes to be offset, including tax credits in favor of the company, such as VAT, tax credit, excess tax credit, taxes withheld by customers, estimated tax returns on the rent.

- Merchandise inventories, raw material inventories, finished product inventories, inventories of packaging material, inventories of office supplies, inventories of cleaning supplies, among others.

- Short-term investments, such as investments in short-term debt instruments.

- Assets held for sale such as land, real estate and others.

- Other non-financial assets that will not be settled in cash such as advances to suppliers, prepaid or prepaid interest, prepaid or prepaid insurance, between others.

Relevance of the current in accounting.

Its relevance lies in the fact that it is directly related to the operation of the company, which is why it is considered to reflect its true liquidity, precisely because of its mobility.

In addition, it is closely related to the nature, mission and vision of the company, in the body of the company, the current, is the circulatory system that provides all branches with vitality financial

Finally, in accounting activity, the current represents the resources and therefore the opportunities that the company has to carry out its financial activity.