In this article you will find:

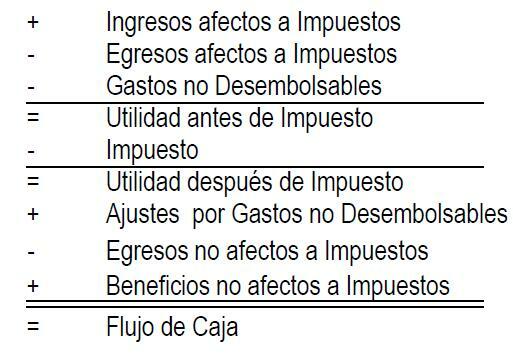

Cash Flow Format

Cash flow (as mentioned above), it is the movement of money into or out of a business or project. It is usually measured over a finite, set period of time. Investment projects, for example, are evaluated for periods of no less than 5 years. Measuring cash flow It can be used to calculate other parameters that give information about the value of a company and its situation. This post mentions the format of a cash flow. In general the cash flow formats they may vary depending on the company. This is because operating costs depend 100% on the company's heading, as well as expenses and other items to be evaluated.

Cash Flow Format Image

Advertisements

Detail of each Item of the cash flow format

- Taxable income: These revenues are all those that have to do directly with the business, that is, sales. For example, if the business is selling shoes, this item represents all the money from sales for this concept.

-

Expenditures subject to taxes: These expenses correspond to all operating costs of the company. This means that it considers those costs out-of-pocket in order to produce the shoes if we continue with our example.

- Non-disbursable expenses: There are some gratos that the company does not pay. It sounds strange to say, but it is. For example, the shoe manufacturing company needs machinery to cut leather. Machinery depreciates over time and its value decreases in accounting. This is a non-disbursable expense, an expense that exists and in which the company does not withdraw a peso from its checking account.

- Profit before tax: This item corresponds to the subtraction of Income subject to taxes - Expenses subject to taxes - Non-disbursable expenses.

- Tax: In this item you must consider the income tax, which in Chile is at least 20%. Companies must pay the state according to the profit they accumulate in a period of one year. If the profit is negative (that is, there are losses) there is a positive balance in the tax for the other year, that is, the tax payment will be less for the other period.

- Adjustments for non-disbursable expenses: In this part the item that was subtracted before tax is added. This is because these expenses are only useful for saving taxes.

- Finally, non-taxable benefits and expenses are added, which are generally minimal differences.

- At the bottom of the format is the Net Cash Flow for the period.

Advertisements