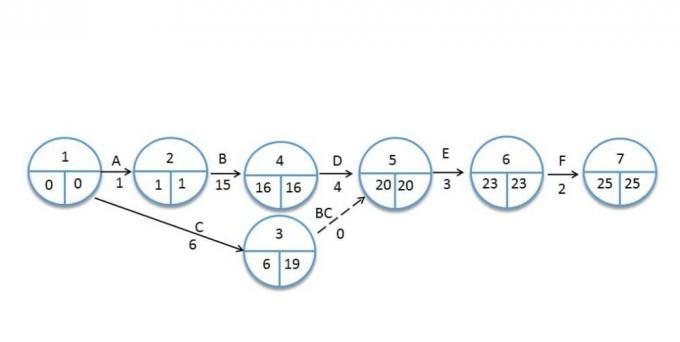

The IRR Means Internal rate of return. It is one of the tools most used to evaluate investment projects. In general, it tries to measure the profitability of a project or asset. Represents the intrinsic average profitability of the project. A manual way to approximate the IRR is to find the rate with which the GO it becomes zero. It is important to note that it is very difficult to try to approximate the IRR manually, for that there are specialized calculation tools with financial calculators, Excel, among others.

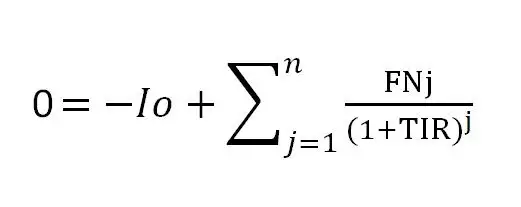

Formula

Advertisements

Where:

Advertisements

Io = Initial investment

FNj = Net flows for period j

Advertisements

i = Discount rate (cost of capital)

Selection criteria:

Advertisements

The IRR it must be greater than the discount rate at which the project is being evaluated. This is because if the IRR is lower with the discount rate you would be earning less money than with the cost of capital, in other words if a bank offers me, for example, an interest rate of 5% for a term deposit of 3 years and the

Disadvantages of IRR

Advertisements

The IRR does not allow to compare projects with different useful life

If it is simple projects (a single sign change in the flows) there will be a single IRR

If there are two or more sign changes, there may be several rates for which the GO it is zero, in which case the indicator loses meaning.

There are also projects for which it does not exist IRR. For example, when all flows are positive.