In this article you will find:

Return on sales

This index seeks to measure the profit-generating capacity of the company and is expressed as a percentage.

There are two indices or ratios that measure profitability on sales:

a.- Contribution margin or Gross profit margin

This indicator shows us the power of the company to produce profits as a result of the line or business, in other words, the operational generation capacity. This index shows the pesos earned, operationally, for each peso that the company sells.

Example: if the margin is 25%, it means that, for every peso that the company sells, 25 cents correspond to gross or operating profit.

In markets, price is an external variable, given the depth of many markets and their high degree of competitiveness. That is why companies focus their efforts to improve margins on reducing production costs.

Advertisements

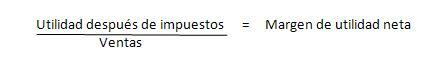

b.- Net profit margin

This profitability index shows the last line of the income statement, that is, the operating and non-operating results. Although both indicators are important, the gross margin shows the real ability of the company to generate profits, because the margin net may be distorted by results of an extraordinary nature and, as such, does not show trends and more difficult behavior is stable.

Example: if a company obtains a high profit from the sale of fixed assets that is written off, it is most likely that it will obtain a high profit profit in that year, but this higher profitability is not sustainable over time, since it was originated by a situation ‘Extraordinary’.

Advertisements

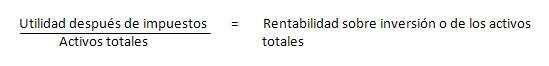

Return on investment

This profitability index is also known as ROA, due to its translation from English (Return On Assets).

The return on total assets is often used as an index. The upper management will assign the objective, since the financial manager is responsible for the totality of the investment for which he is responsible, for which, It must obtain the appropriate profitability, compared with that of the sector, with that obtained in the past by the same company, with the average rate of return of the market, etc. This is because the objective of finance is the maximization of shareholders' wealth and investment policy. It must tend to the highest possible profit, in relation to the investment made, which is reflected in the assets of the business. A ROA of 5% means that for each peso invested by the company, 5 cents are available to shareholders each year or fiscal year.

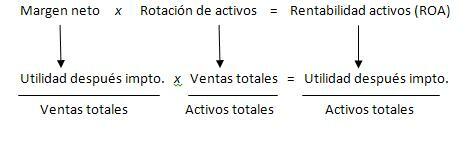

This ratio can also be deducted from net margin and asset turnover:

The ROA is, therefore, the result of the net margin and the turnover, which, generally, are ratios that go in different directions.

This means that companies that sell products with high margins are low turnover (such as automotive companies or aircraft factories), while products with high turnover have low margins, such as food products perishable.

So the manager's challenge is trying to maximize both margin and turnover. In this way, that effort will be reflected in a higher ROA, that is, a higher return on investment.

Return on Equity

Advertisements

This profitability index is also called ROE, for its translation from English (Return On Equity).

This is a measure of return for owners, in the sense that they evaluate the return on the capital contributed, plus undistributed profits. In short, it is an indicator of the profitability of the resources contributed by the shareholders.

An ROE of 25% means that for each peso invested by shareholders in the company (capital and reserves), 25 cents are available to them in each year or fiscal year.