The income statement is a basic financial statement, which shows in an organized way all the results obtained over a period of time, so that they can be analyzed to detect errors that may exist. Its objective is to measure the profitability of the company, improve strategies and thus maximize profits.

In this article you will find:

What is the income statement?

Any company, regardless of its size, or activity in which it is dedicated, needs to obtain information about of the performance of their operation in the determined period, in this way to know quantifiably if they have reached the expected results, maximized their profits and also have a place to lean on to make timely decisions.

In general the different financial statements

Advertisements

In this opportunity we will learn about information regarding one of the main financial statements, such as the conditionfromresults.

Before talking about it, let's understand the basic operation of a company.

Advertisements

Operability of a company

Every company is created with the purpose of generating an economic profit, for this it carries out numerous operations. These operations generate expenses and income. The difference between them is the result obtained by the company in the loss of operability, namely:

Result = Income (less) expenses

Advertisements

If the level of income exceeds the level of expenses, it is noted that the company obtained a utilityIn the opposite case, it is noted that the company has had a loss.

Advertisements

What is understood by income statement?

Also known as Profit and loss, is a financial report that shows in detail and in detail all economic operations, expenses, income, giving as result profit or loss generated in the company during a certain period.

It is an important administrative management tool for any company, which allows you to have a better view of the resources available, the use that is given to them, the entry and exit of money and the cost effectiveness reached. Thanks to this report, the company can prevent and act in advance, in situations that arise.

Advertisements

The income statement allows you to know if the company has made a profit or, on the contrary, made a loss during the financial year reviewed, it also gives know the causes of said event or result, so it is considered very useful for the correct future performance of the herself.

Faced with these two possible positive (gains) or negative (losses) results, the company must undertake the decision making and guide their actions towards clearer and more accurate horizons in the next period of operations.

Objectives of this financial statement

The preparation of this report has specific objectives when presenting the financial scenario of the company.

- The main objective of Statement of income is to measure the performance of all operations carried out by the company in a given period of time, which It is achieved by relating the income achieved with the expenses incurred to achieve the objectives of the business.

By evaluating the information obtained and linking it with other financial statements, different useful objectives are achieved for the best business performance, among these:

- Carry out a fair assessment of the profitability of the company.

- Know the company's ability to generate profits.

- Know how the company can optimize its resources to maximize your profits.

- Measure the financial performance of the company, that is, how much is invested and how much is spent.

- Determine with better bases and information the distribution of dividends according to the profits obtained during the period.

- Estimate the Cash Flow, project future sales accurately using this status as a basis.

- Detect the use that is being given to the economic resources of the company, where the most is being spent, where least and if it can be changed or improved, so that these resources are put to the best possible use.

On the other hand the Statement of income It constitutes an element of support to managerial management, by providing useful and valuable information for the decision-making and strategic planning process.

Importance of the income statement

The importance of this document is that it shows information concerning the result of company operations in a given accounting period, also gathering characteristics of relevance, reliability, easy understanding and comparison to be useful to management when making decisions and planning the course of actions by come.

Between the financial statementsIt is the first that investors see, since it allows them to appreciate the direction of the invested capital and to estimate if they have been properly managed. For the management it constitutes an informative paper of interest, since, it shows the efficiency and effectiveness In the management carried out, it provides detailed information on the results by the different steps towards the final result of the company. For the precise state the result of a business or operation of a company, expressing appreciable and reliable financial information of the company as an entity involved in the development from the country.

Managerially the Balance sheet indicates, in the heading of "how much" the benefits or losses that affect either positively or negatively the assets of the organization. Also making clear the "how" has been determined.

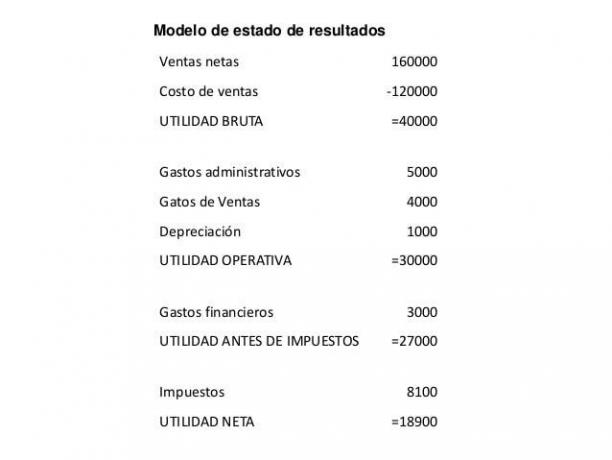

Structure of the income statement

The income statement is composed as follows:

- Sales: is the first piece of information that appears in the study, and shows the total income received.

- Cost of sales: the item that is for sale has a cost for the company, and they are represented in this field.

- Gross profit: is an indicator of the profit of the product. Simply put, it is the difference between sales and cost of sale. A comparison between the sale price of the product and the cost of production / acquisition.

- Operating costs: are all those expenses that are directly linked to the operation of the company. Such as income, basic services (electricity, water, etc.), salaries, among others.

- Utility over flow: are the profits that the company receives without taking into account accounting and financial expenses, such as taxes.

- Depreciation and amortization: These are payments that apply annually to reduce the value of assets owned by the company. Such as vehicles, machinery, etc.

- Utility operation: represents the profits or losses that the company has for its productive activities.

- Financial expenses and products: refers to expenses that are not directly related to the main function of the company, such as the payment of interest.

- Profit before taxes: it is a balance that shows the losses or gains after covering the financial and operational obligations.

- Taxes: all those payments that the company must make to the state as stipulated by law.

- Net profit: indicates the final profit or loss of the company, after counting all income and payments.

Example of an income statement

To understand the concept of income statement, we will see a small example of a trade in the period from January 1, 2019 to December 31, 2019.

| Income | |

| Sales | $20.000 |

| Returns | -$2000 |

| Total revenue | $18000 |

| Expenses | |

| Salaries | $8000 |

| Advertising | $1000 |

| commissions | $1000 |

| Total expenses | $10000 |

| Profit (Profit) | $8000 |

How to interpret a profit and loss statement?

Thanks to the fact that each account described in this report reflects what to do in the different areas, the Income statement makes it possible to assess the operation and management of the business in these areas of the business. For example:

- Sales: It guides the performance of the marketing area, allows analyzing the management of the marketing director through an analysis of the recorded figures, in order to determine if the goals were achieved ruled.

- Cost of sales: It guides the performance of the production area, the operations director's management is evaluated, in order to compare if the profit obtained corresponds to the level of costs that were recorded or estimated for the period.

- Operating expenses: It guides the performance of the administrative area, allows determining the good work of the administrative director, in order to check if he managed to comply with the established budget.

All this evaluation is carried out with the intention of optimizing the company's resources, supporting decision-making, and maximizing the profits and profitability of the business.