Appreciation is a term that refers to the increase in the value of an object or a specific company. This increase in value will depend on each market or even a specific country. The appreciation of a good is determined by several external variables.

These variables can not only affect the increase (appreciation) of the value of an asset, but can also affect the opposite, which is called depreciation. In economic terms, it is a concept widely used in the administrative field, business management, business and finance.

Advertisements

The appreciation has been the temporary or definitive increase in the value of an asset. Generally, this increase occurs when there are adverse situations within the markets, also can be motivated by the mechanisms in charge of regulating prices, known as: supply and demand.

An example of this would be the increase in the price of a work of art. Here, if the property is in high demand due to research on the artist, it is very likely that an attention is originated towards him, which causes it to have an impact on his works, increasing the value of the work of art. This is appreciation.

Advertisements

At the monetary level, appreciation can also be the increase in the value of a coin as a consequence of the comparison with others. This applies when the floating currency conversion regime is not well regulated and in turn, the revaluation system does not apply.

Advertisements

In this article you will find:

Appreciation characteristics

These are the characteristics of the appreciation:

- Increase in demand for the national currency is equal to the appreciation of the national currency.

- When there is an appreciation of the currency, it affects national products making their value more expensive for foreigners and makes foreign products cheaper for residents of the country.

- Appreciation effects:

- Create improvements in the relationships you have during exchanges.

- Competitiveness deteriorates in some national products.

- There is a reduction in rates related to inflation.

- The trade balance, as well as that of goods and services is deteriorating.

- Economic activity decreases.

Causes of appreciation

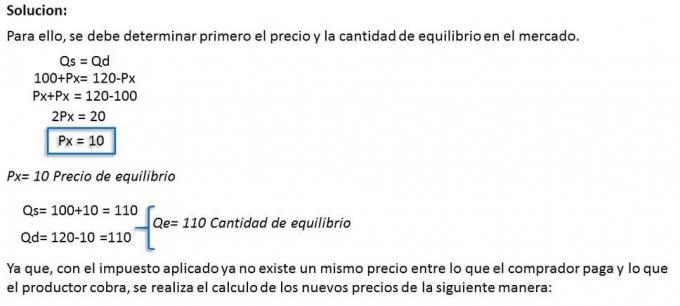

The exchange rate is the price of one currency with respect to another, this is the result of what we know as a supply and a demand. An example could be the supply and demand of currencies. Here there is an appreciation in terms of the national currency, only when there are excesses in the demand for the national currency.

Advertisements

Example: An appreciation will be an increase or a reduction in the exchange rate, this will depend on how the exchange rate is defined:

- If the exchange rate is defined as units of foreign currency, which must be paid in exact amounts to change of national monetary units, the appreciation of the national currency, will mean an increase in the rate of change:

$ / € 0: 1 Euro = $ 1.4 $ / € 1: 1 Euro = $ 1.7

Advertisements

- If the exchange rate (E) is defined as the number of units of national currency when it is paid for single units of foreign currencies, the national appreciation supposes a decrease in the rate of change:

€/$ 0: 1 Euro = $ 0.71 € / $ 1: 1 Euro = $ 0.59

It is convenient to speak of the appreciation of a currency and not of an increase or reduction in the exchange rate, since depending on the The way the change is defined, there will be increases in it, which will mean an appreciation or depreciation of the currency in question.

When there is an increase in demand for the national currency, equilibrium will be restored by increasing the price of the national currency in terms of foreign currency, which is the same, through an appreciation of the currency national.

Revaluation

Revaluation is the system of fixed exchange rates and the increase in the value of the national currency. This occurs as a consequence of a political decision of the government and not of market forces.

It is important to be clear about the difference between appreciation and revaluation. One increases in value when it is effected by supply and demand, while the other is caused by a political decision. It is not the same to say "the currency has appreciated" as to say, "the currency has been revalued."

The appreciation and price of exported and imported products

The monetary appreciation of a country has the consequence of making national products more expensive when they are taken abroad, it also makes foreign products cheaper for residents of the country.

To explain it better, we will show you two examples:

Example 1: How many dollars will a SEAT car cost with a price of 12,000 euros?

- If the dollar / euro exchange rate is 1 Euro = $ 1.4, the car (national manufacture) would have a price of $ 16,800

- If the euro appreciates against the dollar and the new dollar / euro exchange rate is 1 Euro = $ 1.7, the car would be priced at $ 20,400

Example 2: How many euros would a Chrysler car cost that costs $ 20,000?

- If the dollar / euro exchange rate is 1 Euro = 1.4 $, the car of (national manufacture) would have a price of 14,286 euros

- If the euro appreciates against the dollar and the new dollar / euro exchange rate is 1 Euro = $ 1.7, the car would have a price of 11,765 euros

So, if everything else remains constant, an appreciation of the national currency, at the moment when our exports and makes our imports cheaper, will cause a reduction in exports and an increase in imports.

Importance of the company name

It is important to know this concept, since, in modern times, it is a concept that is handled very often. It is important to know when the national currency will appreciate, which is when there is an increase in the demand for the national currency.

It is also important to know that the appreciation of a currency makes national products more expensive for foreigners, since it makes foreign products cheaper for residents of the country.