In microeconomics the consumer tax is another factor that distorts the market equilibrium, affecting both the demand and the supply of goods and services.

The application of these taxes implies a reduction in the quantities demanded by consumers, since they have to assume an additional payment on the value of the taxed good or service when they are purchased or imported; according to the tax rate established in the tax regulations of each country.

Advertisements

In this article you will find:

What is the consumer tax?

It's a tribute or tax lien that falls on the consumer directly or indirectly; which represents a fiscal contribution to help governments finance state public spending.

Advertisements

these tributes arise from a taxable event, which is the situation that gives rise to the obligation to pay by the consumer, facts that are previously established in the tax laws and regulations in force in each country.

Why are consumer taxes applied?

consumer taxes apply for two reasons, What are they:

Advertisements

The first reason is to raise funds from the population "consumers" and thus help finance public spending, such as infrastructure works, security, education, among other expenses; with which to generate a social benefit.

the second reason, is to control the demand or consumption of certain products in the population, as are polluting products.

Advertisements

In Quaker cases, these taxes imply an alteration in the behavior of the market.

How does the consumer tax affect supply and demand?

The consumer tax negatively affects both buyers and sellers of goods and services subject to taxation, distorting the perfect equilibrium of the market.

Advertisements

So it implies that the consumer will have to pay more money to acquire said products or services and in turn the seller will get less economic benefits.

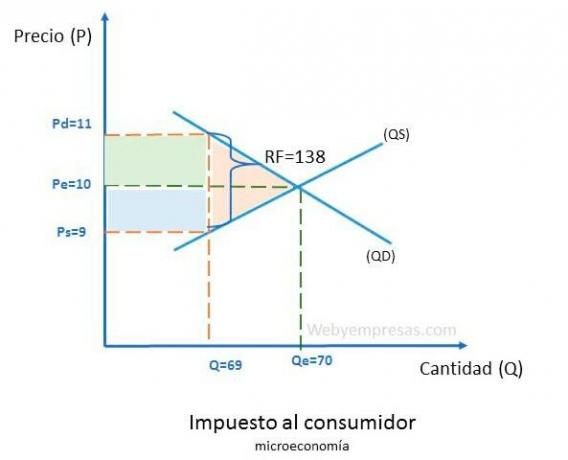

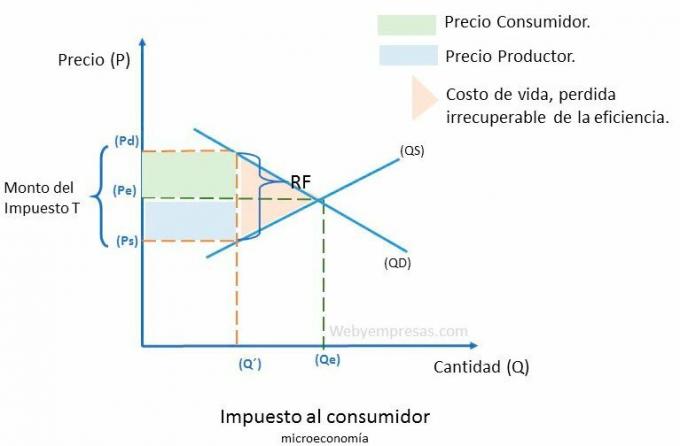

This situation of course affects the demand curve by shifting it to the left, until a new equilibrium point (Pe) is reached.

In which, as the price that consumers have to pay (Pd) increases and what producers charge (Ps) decreases, the quantities offered(Qs) and demanded (Qd) also decrease; therefore, the size of the market for such regulated goods or services shrinks.

Consumer taxes and economic efficiency

The consumer tax can generate a deadweight loss in economic efficiency since prevents sellers and buyers from making a profit, situation that discourages economic agents offering and demanding to remain in said market due to the social cost it represents.

From the point of view of economic theories, the free market is beneficial for society, both for consumers and for producers, gaining both parties with an acceptable equilibrium price, which generates a surplus for both the consumer and the producer. producer.

The problem arises when the state imposes taxes, such as the consumer tax, since, those profit surpluses for the buyer and seller decrease, generating a loss in social welfare.

Since, in a simple economy in relation to even a certain market, the sum of consumer surpluses and those of the producer is equal to social welfare, therefore, a decrease in surplus translates into a loss in said welfare Social.

A lost than governments with tax collection to the consumer are unable to fully recover; since, when the exchange of goods and services subject to the tax is reduced, its collection does not increase nor the social benefits generated with them, causing the loss of well-being to be irrecoverable.

consumer tax

There are many types of taxes that affect consumersAmong those taxes are:

Value Added Tax (VAT)

It is the main source of consumer tax collection; which is an indirect tax falls on the value of a good or serviceat the time of making your purchase, being a progressive tax whose tax burden is established as a percentage; therefore, the higher the value, the higher the tax to be paid.

this tax is intended solely for the final consumer and although through the marketing chain the producer also pays (VAT) tax credits when making purchases taxed, it compensates them with the (VAT) fiscal debits that it charges for the state at the time of making the sales recorded.

Therefore, although the final consumer is the one who makes the fiscal contribution, it is the producer who exercises the role of taxpayer, declaring and paying the taxes collected to the treasury.

corrective taxes

They are taxes that apply in order to penalize and reduce the consumption of products that have a negative impact on society, such as the consumption of highly polluting products, among these are the consumption of plastic bags, fuel consumption, among others.

Graphic representation of the effect of the consumer tax on the microeconomy

Where:

- Ps= Offered price.

- Pd= Demand price.

- Q'=Quantity.

- T= Tax amount.

- RF= Tax collection.

Formulas:

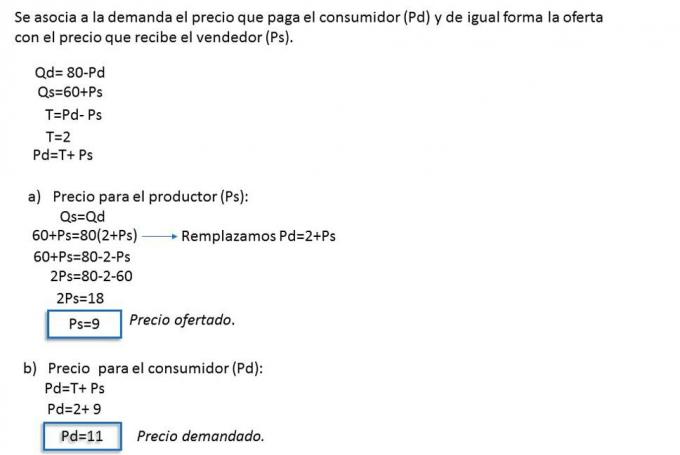

- T= Pd-Ps.

- Pd= ps + T.

- RF= Q´ x T.

To represent the graph of the effect of the consumer tax on the market, the following must be taken into account:

- The seller is willing to offer at a price (Ps) for a certain quantity (Q´) and in turn the buyer is willing to demand at a price (Pd) for a certain quantity (Q´).

- The amount of the tax (T) is the difference between the (Pd) less in (Ps).

- Quantities supplied (Qs) and quantities demanded (Qd) are less than the break-even quantities (Qe).

Therefore, the impact or effect of the tax collection is shared between the bidders and the demanders.

Let's see the graphic representation:

Now, if you want to determine the social cost of the consumer tax, you just have to apply the following formula: CS= ((Qe-Qd) x T) /2

Practical example of the effect of the consumer tax in microeconomics